operating cash flow ratio ideal

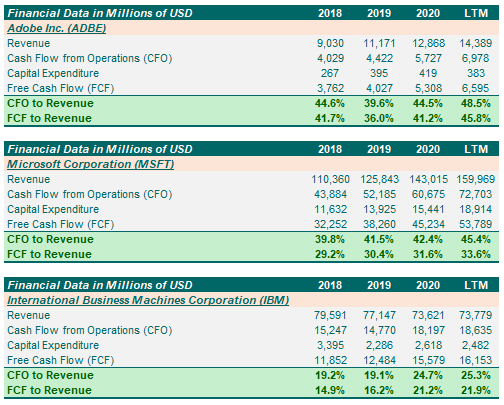

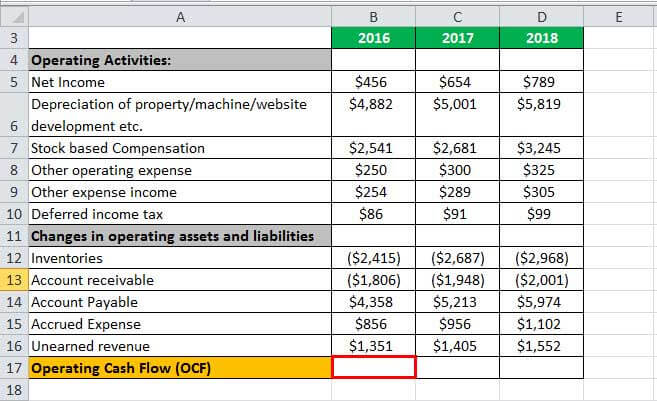

Operating cash flow ratio. This ratio can be calculated from the following formula.

Operating Cash Flow Margin Formula And Calculation

It shows how much cash.

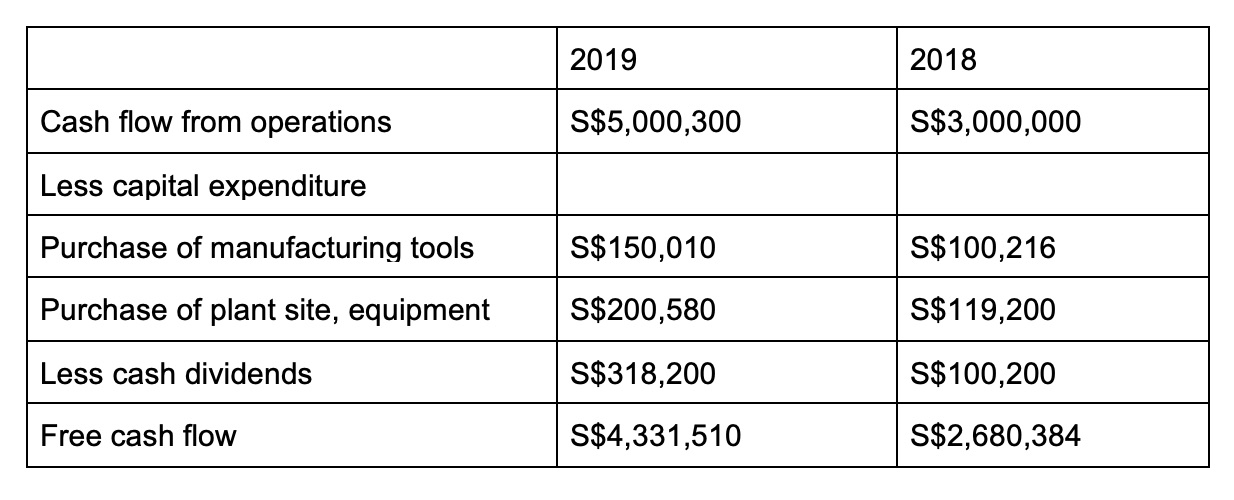

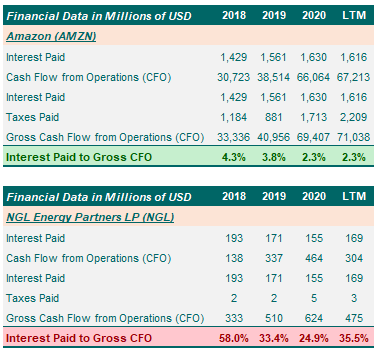

. The cash flow-to-debt ratio is the ratio of a companys cash flow from operations to its total debt. Operating cash flow Sales Ratio Operating Cash Flows Sales Revenue x. Calculation formula The formula for this ratio is simple.

The cash flow from operations or OCF is a key metric in companies account statements. Cash Flow-to-Debt Ratio. They use some ratios more frequently used than others depending on the business and its financial needs.

If the operating cash flow is less than 1 the company has generated less cash in the period than it. The operating cash flow ratio is a measurement that indicates whether the cash created from continuing operations is sufficient to pay for the current obligations your. Since the ratio is lower than 1 it indicates that Bower Technologies has a weak financial standing or is.

This ratio is similar to the cash ratio. Ideally your operating cash flow ratio should be fairly close to 11 meaning you make 10p per 1 you. Thus in this case the operating.

Put simply its a. Cash returns on assets cash flow from operations Total assets. Lets consider the example of an automaker with the following financials.

Example of Cash Returns on Asset Ratio. In an ideal situation when sales revenue increases cash flow should. For instance if 90 days receivables are outstanding it means on an average the company extends credit for 90360 25 of its sales at any given point of time.

The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. 872 975. Operating Cash Flow Margin.

Each ratio reveals a specific financial aspect of the company. The price-to-cash-flow ratio is a stock valuation indicator that measures the value of a stocks price to its cash flow per share. Instead we use the.

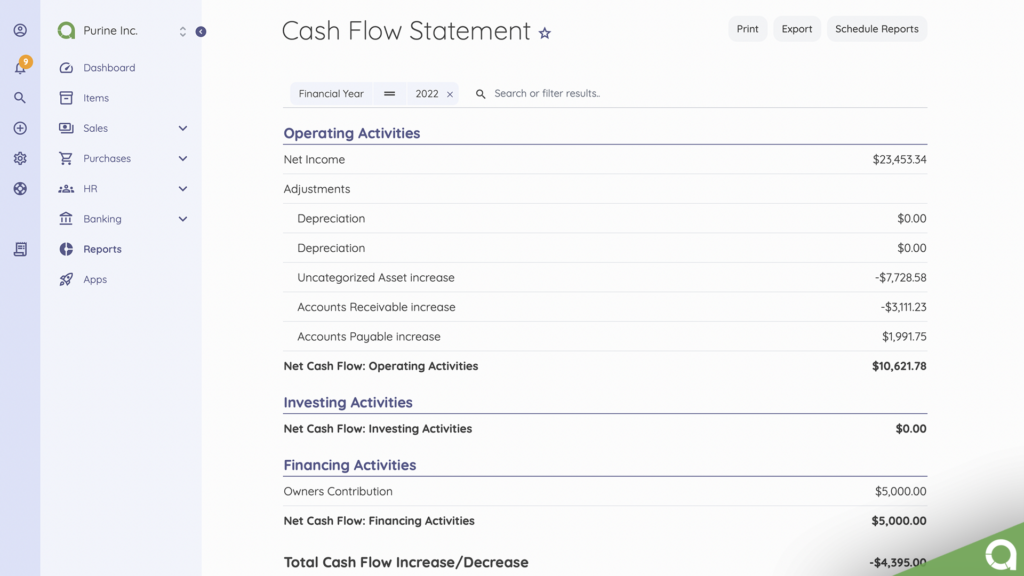

The operating cash flow ratio is a measure of a companys liquidity. Operating cash flow Net cash from operations Current liabilities. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales.

This ratio is a type of coverage ratio and can be. 43 rows What you need to know about the operating cash flow ratio. The formula to calculate the ratio is as follows.

However we do not use the most liquid money and assets currently held by the company. The operating cash flow to sales ratio is a popular metric used to compare current cash flow against sales revenue. OCR Ratio Cash flow from operating activities Current liabilities.

Operating cash flow margin is a profitability ratio that measures your businesss cash from operating activities as a percentage of your sales revenue over a given period.

8 Cash Flow Ratios Every Investor Must Know

Cash Flow Coverage Ratios Aimcfo

Cash Conversion Ratio Financial Edge

What Is Operating Cash Flow And How To Calculate It

Free Cash Flow What This Metric Tells You About A Company S Financial Health Standard Chartered Singapore

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash Flow Margin Formula Calculator Updated 2022

How To Create A Cash Flow Chart Easy To Follow Steps

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

6 Types Of Cash Flow Ratios And How To Use Them Indeed Com

How To Calculate Cash Flow 3 Cash Flow Formulas Calculations And Examples

Price To Cash Flow P Cf Formula And Calculator Step By Step

8 Cash Flow Ratios Every Investor Must Know

Using The Price To Cash Flow To Find Value Screen Of The Week Nasdaq

7 Cash Flow Ratios Every Value Investor Should Know

Operating Cash Flow Formula Calculation With Examples

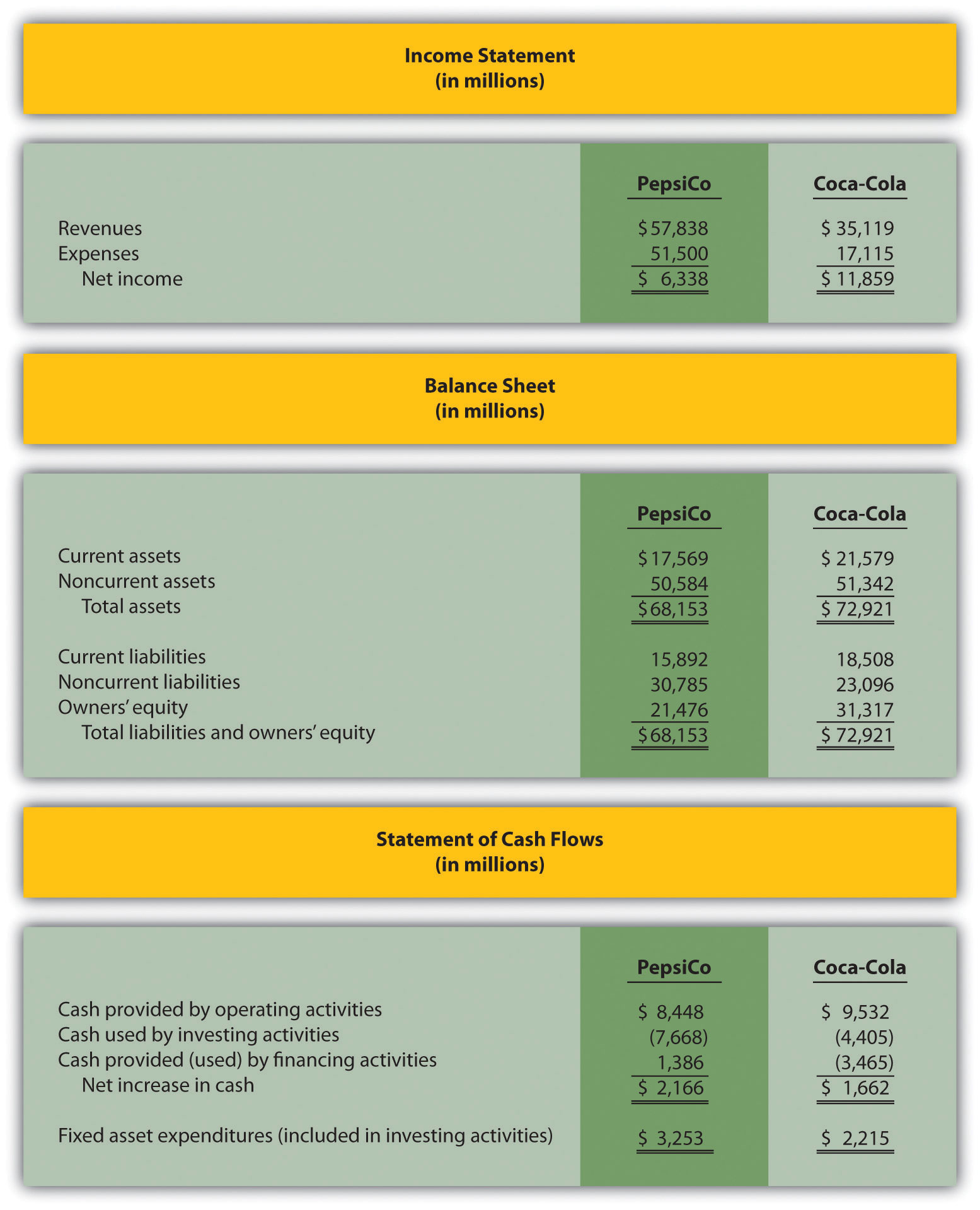

Analyzing Cash Flow Information

Financial Debt Ratios Calculator Get Free Excel Template

Price To Cash Flow Ratio Formula Example Calculation Analysis